Our thesis and insights

Driving technological innovation into banking: partnering over building or buying?

April 15th - 2024

In 2022, the global banking industry generated $6.5 trillion in revenue, one of the biggest revenue pools across any industry. Interestingly, only 5% of these revenues are generated by challenger fintechs – yet, the picture unfolds against a backdrop of significant transformation, with capital shifts and disintermediation happening at a faster pace than often perceived, across all lines of business of financial services.

Assets and clients are gradually shifting from traditional, capital-heavy financial institutions like universal banks to more agile, capital-efficient entities – at times replicating the experience of incumbent banks and other times providing a single product offering very well-tailored to the new, increasingly digital client. This evolving financial ecosystem now includes payments systems, independent asset managers, private capital equity firms, financial data and infrastructure businesses, and notably fintechs. McKinsey projects that by 2028, fintechs will surpass $400 billion in revenue globally, expanding at an annual rate of 15% – nearly three times the growth rate of the traditional banking sector’s growth.

Such dynamics underscore a crucial reality: innovation, digitization, technology, etc. – you name it! – is not just part of the banking industry’s infrastructure; it’s a fundamental component of its operating model and its future value.

However, despite significant IT spending by incumbent banks – estimated by Gartner at $652 billion globally for 2023 – incumbents have struggled to harness the full potential of these investments as a driver to internalize innovation. The Boston Consulting Group (BCG) notes that while banks allocate on average 11% of their revenues to IT, only a fraction (20 – 25%, likely generously) of this investment is directed towards genuine innovation, i.e. to changing the past as opposed to perpetuating it.

The challenge is stronger in developed economies, where the status quo is more deeply engrained into the workings of the industry, and legacy systems and complex tech setups impede the agility and innovation one can find in the thriving start-up ecosystem. There is a strong need for both European and American banks to enhance digital services and differentiate competitively while at the same time coping with increasing cybersecurity risks and new regulatory demands. The solution lies in a consistent boost in technology investments aimed at fostering innovation. Investment in technology that changes the core vs. perpetuates it, is vital for banks to remain competitive in an environment with more unclear competitive sets, tightening regulation and technological disruptions that threaten the very core building blocks of the traditional industry – only a few of the potent forces shaping the industry’s future.

Regulatory changes are significant. The Basel III endgame, with its emphasis on managing credit, market, and operational risks, alongside the growing calls for data protection under Open Banking frameworks (in the UK, the EU, and increasingly pretty much anywhere) and the surge in ESG requirements, highlights the increasing regulatory scrutiny in the banking industry.

Technological and derived business model innovations, however, continue to be the linchpins of transformation, with higher tech investments correlating with improved and more sustainable bank performance and competitive positioning. This began with the product digitisation and continues with the current transitioning to cloud and blockchain-based technologies, which enables cost reduction and scalability. As integrating new technologies or software can be complex and resource intensive, banks are also increasing the number of strategic partnerships with their immediate technology ecosystem (let’s call that “fintech”!) aimed at enhancing customer engagement, operational efficiency, revenue growth, differentiation and, more generally, “future proofing”.

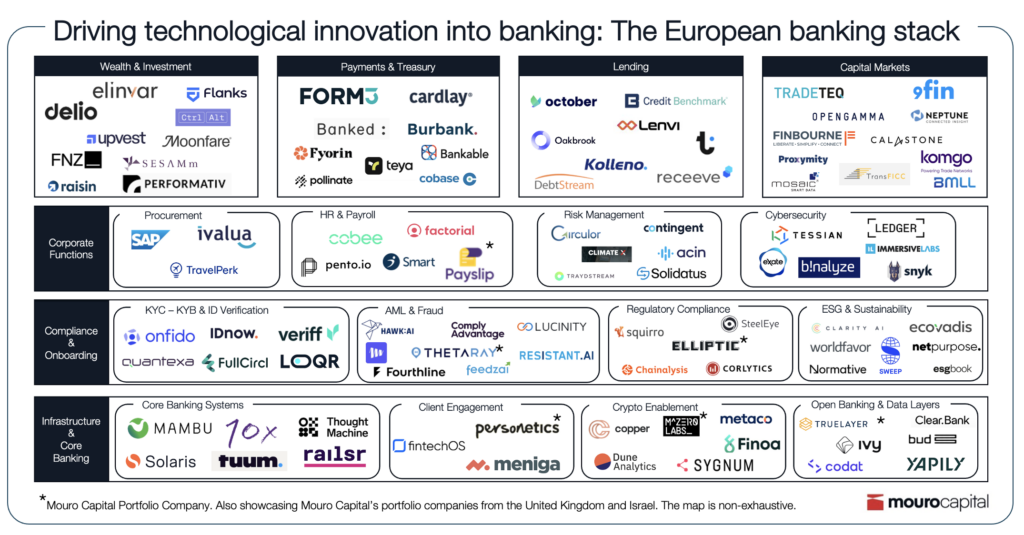

Our market map, which builds upon our previous article about selling to banks, showcases how fintechs and tech companies are collaborating with European banks to digitize processes, distribute financial services more effectively, and achieve cost efficiencies or revenue growth. Start-up <> Bank partnerships allow innovative emerging companies and innovation-starved incumbents to get the best of each other. At Mouro Capital, as venture capitalists but also innovation strategist, we have been strongly advocating that, within the “Build-Partner-Buy” spectrum, partnering provides banks with the most cost-efficient ability to test whether new concepts and ideas are right for them. As a venture fund supported by incumbent capital, we excel at creating the connections needed for incumbents to innovate and portfolio companies to derisk themselves by partnering with new flagship clients.

At Mouro Capital, our ambition places us at the forefront of this evolution, supporting visionary founders and innovation-hungry banks in their own journeys.

Click here to subscribe to our newsletter.