Our thesis and insights

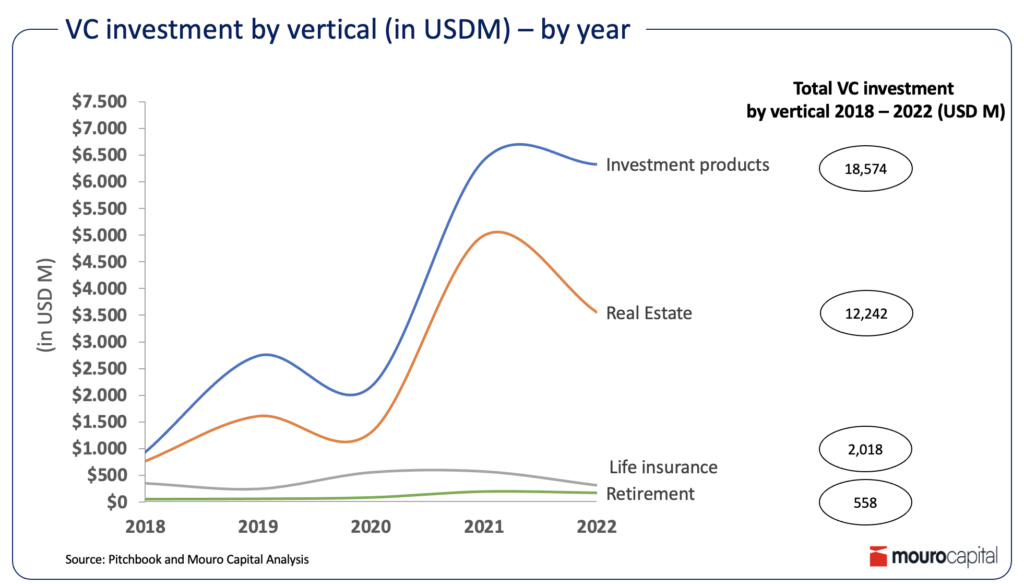

We’ve seen a surge in investment over the past years in companies that innovate financial planning for key life events. Billions of dollars have flowed into the space, and it’s fair to say the investment is paying off in terms of innovation. Roboadvisors have used technology to improve personalised investing and financial planning, companies like Moonfare have helped to democratise access to private markets, and there is a boom in specialist companies to better manage debt and student loans.

But one area that lags the curve is estate planning. This is, perhaps, not surprising: no one likes planning for the inevitable, even though the case is now more compelling than ever. By 2030, 1 in 6 people will be aged 60 or older, swelling the 60+ population globally from 1 billion in 2020 to 1.4 billion in just 10 years. Over the next two decades, some $84 trillion of wealth will pass from the hands of baby boomers to their children and successive generations.

So, what is estate planning and where is there room to innovate?

Essentially, estate planning comes into play at the point of retirement and continues thereafter. The biggest early requirement from a consumer perspective is for products and services that smooth the tax-efficient transition from employment to pension or other alternative sources of late-life income. This space is, and will likely continue to be, dominated by specialist consultancies and advisors rather than tech providers.

But then there’s the next stage: inheritance. At the end of life, how do you ensure the transfer of wealth to your loved ones with minimal tax erosion and with as little administrative burden as possible? Here, lawyers, Will providers, Trust administrators and life insurers all come into play.

Here, the space is scattered with legal landmines and complex tax arrangements, which helps explain why innovation and the associated level of investment has been slow to appear. On the tax front, complexity lends itself to low margins, difficulty in crossing regulatory borders and therefore achieving scale, a level of specificity that makes digitalisation oblique, and the overall perception of low return for innovating the field. From a product perspective, most estate planning instruments are highly regulated, leaving little waggle room for streamlining or improvement.

So, where innovation is to be found, it’s in the distribution of estate planning tools and channels, like the current genesis of insurtech. The problem is that this still doesn’t get around the issue of margin. These will mainly be B2C models whose path to profitability lies in offering ancillary products and services at the edges. That, in turn, means customer acquisition, close engagement and upselling will be key to success. Margin-boosting performance is most likely to come from a shift to subscription services and away from the high touch business models that typically rely on fees for assets under management.

We can also expect much fuller integration of estate planning into whole-life planning, where technology enables a full range of services including spending, investments, debt, and insurance in a more personalised and cost-efficient way. Companies like Range, Arta Finance or Vise in the US are early examples. They combine investment services with tax planning, insurance optimisation and retirement planning through their all-in-one wealth management tool, which makes financial planning widely and easily accessible, supported by in-house licensed financial advisers and proprietary AI technology.

So, with ample opportunities in the space – albeit requiring careful planning and execution to maintain their vitality – we may yet see some new life breathed into the end-of-life market. If you’re an early-stage team in the European, US or Latam markets, building and innovating in the space, we would love to hear from you.

Click here to subscribe to our newsletter.