Our thesis and insights

How horizontal differentiation can help corporate card platforms secure long-term growth

April 27th - 2022

Despite comprising less than 1% of the $150 trillion+ B2B payments market, the commercial card space represents a huge opportunity for fintechs.

While investment in technology and automation is increasingly a priority across industries, expense management processes are still predominantly manual. As a result, businesses of all shapes and sizes struggle with inefficient and resource-heavy processes, high costs, and lack of visibility into their spending.

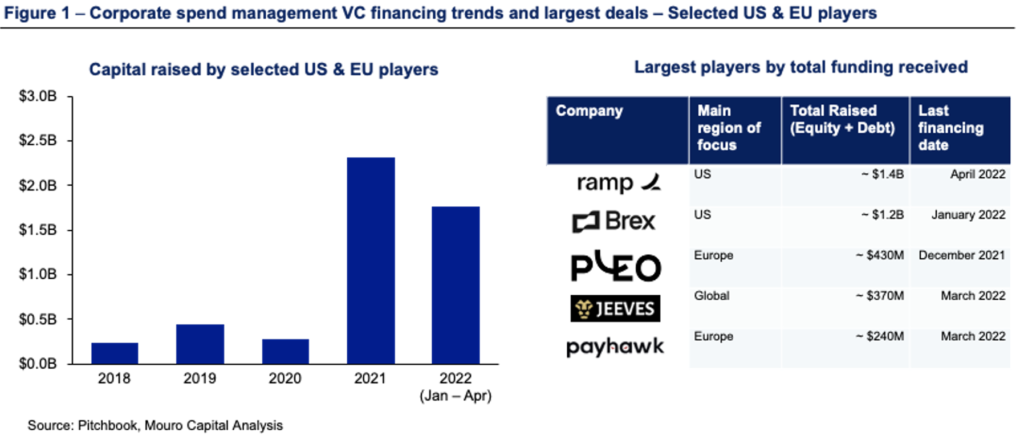

Unsurprisingly, investment in digital-first corporate card platforms looking to swoop in and disrupt the market has grown exponentially. In 2021 alone, they raised over $2.3 billion in venture capital funding and have showed no signs of slowing in 2022 with $1.8 billions raised in the first four months of the year (Figure 1).

But while this funding has enabled growth through offers such as discounts and cashback, the unit economics and growing competition mean these tactics may be unsustainable in the long term.

Interchange fees — the lion’s share of corporate card platforms’ revenue — hover at around 1.5% net of card network fees, processing fees, and issuing fees. To put into context, a company would need to process nearly $7 billion to generate $100m revenues. Generous introductory offers make customer acquisition extremely expensive and risk wiping out already narrow margins.

Crucially, advances in technology and new approaches to regulation mean the ability to issue corporate cards on demand is no longer a competitive differentiator.

To become the financial operating system of choice for the companies they serve — and ensure long-term sustainability — corporate card platforms must expand their capabilities bringing customers into an ecosystem, integrating with other services and building a distinctive experience. In our view, doing so horizontally is the best way to go.

Why vertical differentiation isn’t always the answer

In highly competitive spaces, vertical differentiation is typically seen as the most effective way to gain market share, for two reasons.

First, because a specialised product has a narrower focus, it can address industry-specific pain points. And while this means the product will appeal to a smaller customer base, its highly targeted nature will make it more valuable to that segment.

Second, specialisation unlocks economies of scale, with the more homogenous customer base lowering acquisition costs.

Case in point, specialising in fleet operators has allowed Coast to develop distinctive capabilities tailored to specific needs, including visibility and control over how many litres of which fuel staff are buying for which vehicles.

The highly targeted nature of Coast’s offering has attracted the interest of several tier-1 investors but if the advantages of carving out a niche are compelling, there are also limitations.

Because specialised platforms have an inherently narrow focus, they don’t have the capability to offer customers a unified view of their incomings and outgoings — a feature that would save time as well as improve the accuracy of their bookkeeping and their understanding of their finances.

Customers will still have to switch between apps or integrate with a third-party platform to get a complete view of their expenditure. And that’s assuming there are no interoperability issues: the average SME employee uses 6 apps in the course of a workday.

More to the point, vertical differentiation creates fewer opportunities for upselling, cross-selling, and developing new revenue streams. So while it may help you stand out and grow in the short term, there’s less potential for boosting lifetime customer value.

The case for horizontal differentiation

Before we dive into the advantages of differentiating horizontally for long-term growth, it’s worth noting that this strategy has risks, mainly because the market is crowded and many start-ups in the space are very well funded, which in itself can constitute a moat.

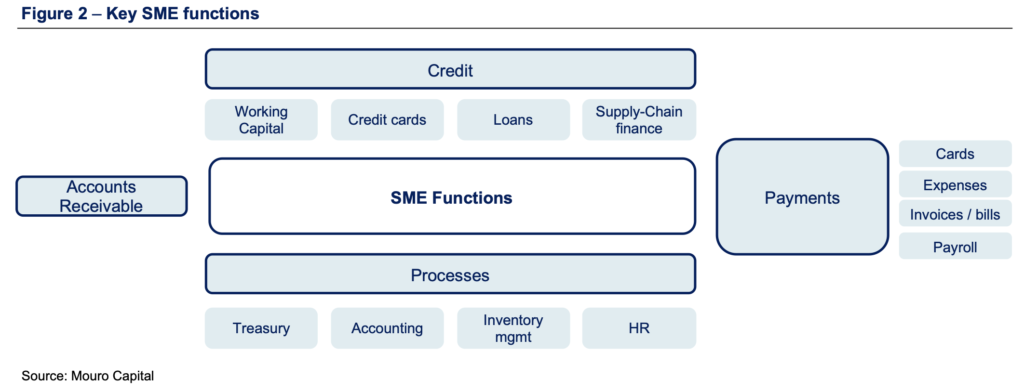

While, in recent years, banks have lagged behind when it comes to meeting the needs of fast-growing SMEs and larger corporates, they’ve traditionally acted as companies’ financial operating system of choice, the de facto go-to entity for any existing or new financial need. And this makes it difficult for businesses to disentangle themselves completely (Figure 2).

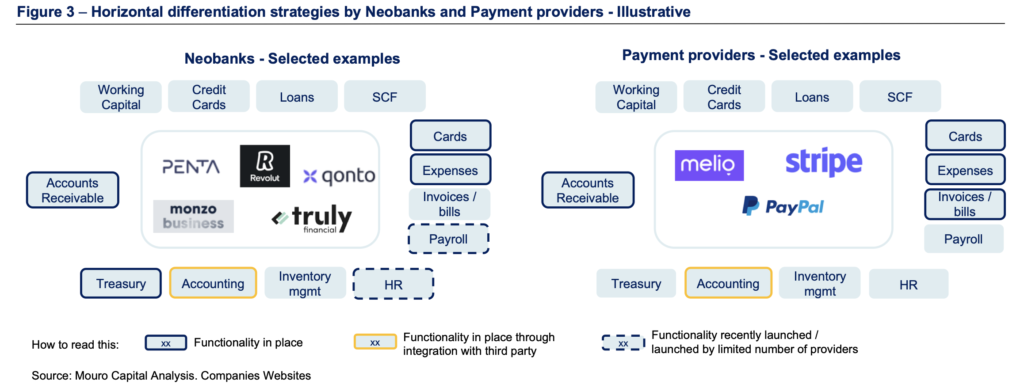

At the same, neobanks such as Revolut, Monzo, Qonto, and Penta are creating innovative products that enable businesses to pay, get paid, and streamline their expense management process from one place, as well as offering value-added services such as invoicing, FX management, and payroll management.

Front-end enablers like Paypal and Stripe and accounting services like Pennylane have also launched their own expense management tools for business — including cards with custom controls — with the aim of becoming the central hub for everything related to financial management (Figure 3).

From this perspective, differentiating horizontally takes you out of one competitive space only to put you in an equally if not more competitive space. One that’s packed with incumbents and extremely well-funded, aggressively expanding new entrants.

That said, the risk also comes with a considerable upside.

By providing your customers with a one-stop-shop, you can offer more value, build new revenue streams, and ultimately, create a product your customers are more likely to stick with in the long term.

How to succeed at horizontal differentiation

One of the main criticisms of horizontal differentiation is that trying to appeal to a wider cross-section of customers risks having the opposite effect by making a product come across as generic.

But this assumes that horizontal differentiation is a race to incorporate as much functionality as conceivably possible.

That’s far from being the case. Corporate card platforms experiencing the fastest scale have been able to successfully identify areas where businesses were underserved and created compelling solutions. Put it simply, they’ve been able to bring customers into an ecosystem, integrating with other services and building a distinctive experience which connects people and data.

For example, Brex launched its charge-card proposition targeting fast growing SMEs who would typically struggle to get approved by banks. Brex application would take minutes instead of days, was entirely digital and didn’t require personal guarantees.

After gaining initial traction, Brex diversified its product suite by launching a cash management account which offered bank-account like functionalities and a credit product, offering borrowers debt financing based on their recurring revenue.

Similarly, Rho have expanded their spend management platform to encompass the whole accounts payable lifecycle. They also offer business banking in partnership with Evolve Bank and Webster Bank, and a treasury account which allows customers to earn interest on reserve capital.

Horizontal differentiation for the win?

As the battle for dominance in the corporate card space heats up, we believe that platforms that differentiate horizontally stand to gain a significant edge.

By adding features that complement spend management — payment processing, payroll, invoicing, and, particularly, borrowing facilities — platforms can position themselves as centralised financial operating systems their customers can rely on to automate resource-heavy manual processes, unlock critical data, and gain more visibility and control over their finances.

And that will create opportunities to increase product stickiness and customer lifetime value.

That said, this is not a zero-sum game.

If bill.com’s recent acquisition of Divvy is anything to go by, we’ll likely be seeing some consolidation in the coming years, with vertically differentiated businesses joining forces so they can play to each other’s strengths.

Similarly, given the regulatory complexities of highly specialised sectors like insurance and healthcare, there will no doubt be a market for cleverly-targeted, vertically-differentiated offerings.

But while no-one can be certain what the future holds, the corporate card platforms that do gain the edge will undoubtedly share three key characteristics.

First and foremost, they’ll adopt a more strategic approach to customer acquisition. While discounts and cashback may be effective in the short term, competing on price will inevitably create a race to the bottom and hamper profitability.

The smarter play is to develop in ways that encourage customers to stick around. Offering products with longer life-cycles like loans, for instance. Or developing new features that save customers time and money and give them more visibility into their financial health as they scale.

This brings us to the second key characteristic.

Regardless of whether they differentiate vertically or horizontally, platforms need to identify where their customers are underserved and develop smart solutions that address those pain points. Designing a feature and identifying market fit later isn’t an efficient or effective way to grow. The product must develop in response to pressing customer needs. Customer feedback is crucial in designing and evolving the product.

Lastly, while it raises its own unique set of challenges, geography will also play a part.

Where developed markets like Europe and the US are edging closer to saturation point, selected emerging markets in Latin America, MENA and Asia remain underserved, not only by the number of start-ups in the space being less, but also by the need for them to rebuild infrastructure in their markets that are readily available in Europe or the US.

Corporate card platforms that can navigate these jurisdictions’ stricter regulatory requirements (and predominantly cash-based economies) could emerge as key industry players in the medium term.

Click here to subscribe to our newsletter.