Our thesis and insights

Opportunities in insurance – The intersection of technology and risk

October 27th - 2022

For an industry that thrives on looking ahead to anticipate the unknown, Insurance has been surprisingly slow to embrace technology innovations. The industry is dominated by companies founded decades ago, often relying on outdated systems and manual processes.

More recently though, the past few years have witnessed increased funding heading towards players trying to disrupt or bring technology innovation to this most traditional of spaces. Billions of dollars have flown to the whole value chain from direct to customer proposition to technology supporting underwriting administration and claims.

Between 2020 and 2021, the first wave of these new providers went public and suffered the same ups and downs as the entire tech market more recently. This shows both that there is a recognition of the technological innovations that can be implemented in the industry, but also that there is still a long way to go in having technology provide a competitive advantage against incumbent businesses.

In this first piece of a series on insurance, we look at how risks and technology are interacting to create the future winners in the space being it carriers or solution providers who will accelerate incumbent’s digital innovation paths.

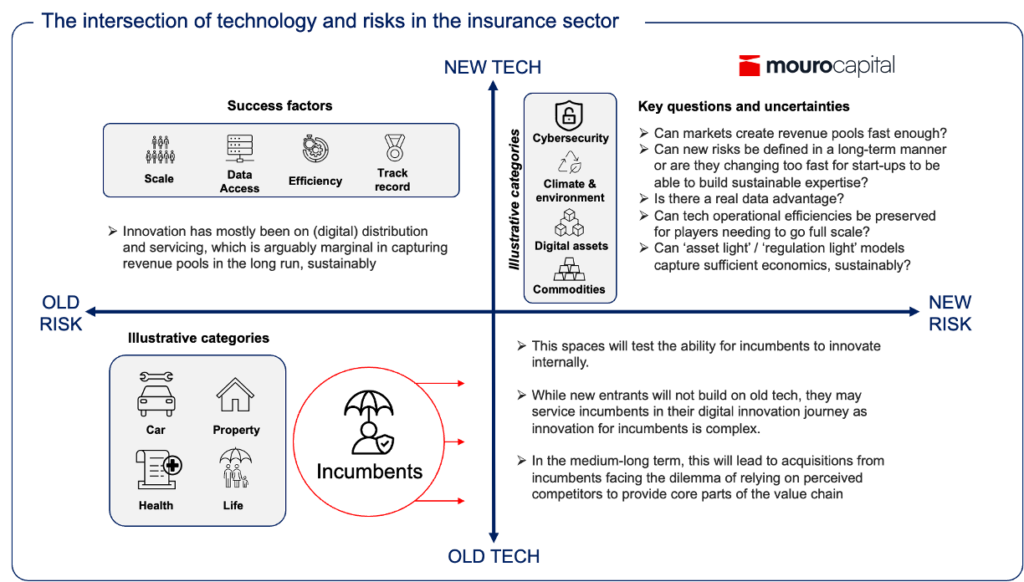

Navigating the quadrants at the intersection of risk and technology, we start at the bottom left: old risk, old tech. Herein lie the incumbents. While players in this quadrant have been facing headwinds on revenue growth and challenges in reducing costs, direct written premiums (DWP) for old risks such as property and casualty (P&C), life and health have all been in the trillion dollar volumes in developed countries in 2021.

Top left quadrant: old risk, new tech. Broadly speaking, the reinvention of incumbent practices by tech savvy newcomers. Scale, operational efficiency, data access and track record are key to success here. Which explains why, even if several new B2C consumer propositions have appeared of late, there are relatively few success stories. This is primarily down to scale but differentiated actuarial capabilities have also proven to be weak spots. Innovation has mostly been along the lines of (digital) distribution and servicing, which is arguably marginal in building sustainable revenue pools in the long run. Holding a license aside, incumbents still benefit from two advantages, years of claims history and diversified risk exposure to support underwriting. Second, they spend large amounts on brand and marketing, driving up customer acquisition costs.

Bottom right quadrant: new risk, old tech. Here, we see the natural evolution of incumbents as new risks emerge out of societal and economic changes, or from expansion of markets brought about by data and technology. New entrants typically will not enter this space as they don‘t build on old tech, so the segment will test how well incumbents innovate internally. Our assumption is that, since internal innovation is complex and tends not to work so well, a new set of players from the upper right will become service providers to incumbents in their digital innovation journey. This might be accelerated if the newcomers fail to mature quickly and show sufficient entity and revenue pools. But back to the bottom right: at some point incumbents will have to choose between relying on competitors to provide core parts of their value chain or buying up their suppliers to break the dependency. The speed with which the upper right quadrant can scale will determine how much acquisition happens, and on what sort of terms.

Upper right quadrant: new risk, new tech. This is the new white space, occupied by new entrants wanting to tap into revenue pools of the future. Some will succeed and write their name in the insurance Hall of Fame in years to come, but fundamental risks and uncertainties nonetheless remain. Can markets create revenue pools fast enough to meet their demand? Can new, long-term risks be defined or are they changing too fast for startups to be able to build sustainable expertise? Is there a real data advantage? Can tech deliver sufficient operational efficiency for players that need to reach scale? Conversely, can ‘asset light’ and ‘regulation light’ models capture sufficient economics, sustainably?

Conceptually, this long list of unknowns makes for the most interesting of market conditions, as it offers the most experimental outlook — which is what excites us most at Mouro Capital!

Click here to subscribe to our newsletter.