Our thesis and insights

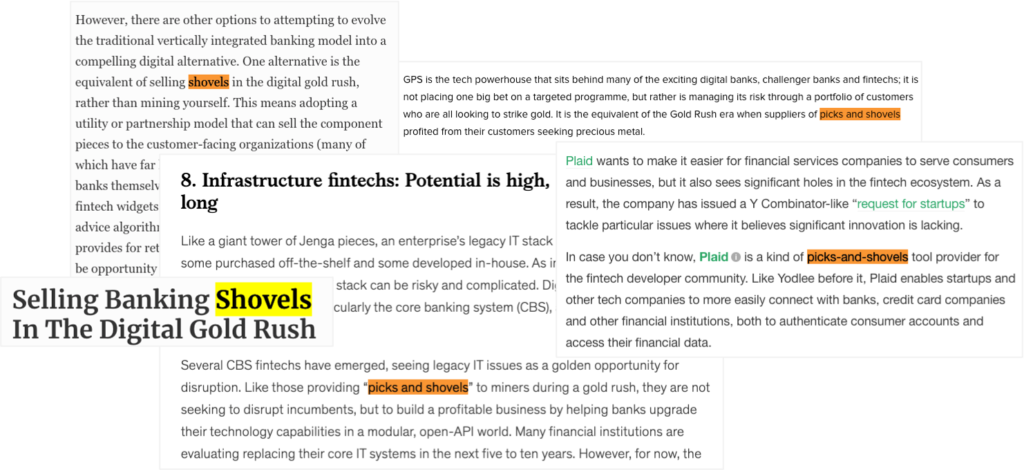

Rejecting the gold rush of ‘pick and shovel’ analogies

November 2nd - 2020

Don’t get me wrong, I love a good analogy – it helps turn a complex topic into something relatable and digestible. My previous blog, Banking-on-a-Headache for instance, references the fintech-AWS comparison.

But, as an active investor in the embedded finance space, I feel the current trend of comparing fintech infrastructure to ‘picks and shovels’ falls short of communicating the real value and potential of such platforms.

The category-leading finance ‘as-a-service’ providers reshaping the industry are so much more than a pick or a shovel, and I’m proud to say we’ve just invested in a company that really helps demonstrate this: brokerage infrastructure provider DriveWealth.

Rather than the usual ‘why we invested in…’ blog, however, I thought I’d talk about the company in the broader context of embedded finance platforms. Specifically, if infrastructure is the future of fintech, what do we believe makes a great infrastructure business…?

1. Enabling innovation, not just lowering barriers to entry

One of the key selling points for any ‘as-a-service’ platform is likely to be their developer-friendly, API-first approach. Unlike finance infrastructure of old, most of the modern providers sell themselves as ‘plug-and-play’ products which can easily be integrated by developers in a matter of days or weeks. Stripe is the pioneer in this regard: payments in just a few lines of code.

But, as important as ease of integration is, it mustn’t be confused with, or be at the expense of, product depth and flexibility and the innovation this can enable.

Let’s take the wave of new debit card offerings as an example. Features that had previously been cutting edge (e.g. card blocking, instant notifications, etc.) are now a commodity, and a start-up with only modest funding can spin up a virtual card and account offering with all this functionality from a banking-as-a-service platform in a matter of weeks.

In some ways this sounds great, but if the BaaS platform is limited to providing a vanilla version of a commodity product, there’s a risk that they remain a tool for prototyping/market testing, or they become the destination for a long tail of under-funded customers that struggle to scale. Neither of these are good outcomes as they imply relatively high customer fatality and/or churn.

Serving a long tail of customers is of course not necessarily a problem. Again, Stripe is a great example of this, servicing a huge SME market with a self-service offering. But for B2B2C models in areas such as investments and banking, we believe that the leading infrastructure providers will be those that offer much more than easy, low cost integration, and that the best products will provide the functionality and flexibility to enable entirely new product use cases: powering the future, not just commoditising the past.

DriveWealth’s API-first platform has reduced the barriers, cost and complexity of offering access to US securities, but at the same time their ‘fracker’ engine (which delivers fractional share trading) has also enabled its customers to create completely new features – for instance, ‘stock-back’ (stocks instead of cashback) and ‘invest the change’ offerings (round up your spare change into stock). The potential for DriveWealth isn’t that it can help create a hundred new Robinhood competitors, but that it is opening up the asset class globally and helping innovators dream up something new.

2. Removing the threat of the ‘build vs buy question’ at scale

One of the main appeals of ‘infrastructure-as-a-service’ is that the client doesn’t need to build the complex technology, get all the regulatory licensing or hire in-house experts to create the product. Particularly in the early stages of a start-up’s life, the build versus buy calculation is straight-forward: several years of development and millions of dollars of investment, versus a product in market within weeks or months.

However, at scale, when the client is likely paying substantial sums to the infrastructure provider, and the product has become integral to the overall proposition of the company, it’s inevitable that the question of “should we build this ourselves” comes up.

For providers of commodity, this point is a dangerous one. Price inevitably becomes a primary consideration for clients and it’s easy to end up in a race to the bottom. If all you are offering is a standardised pick or shovel, then it won’t take long for customers to shop around or question whether they can make better, cheaper ‘digging tools’ themselves.

So how do you prevent customers churning when they reach scale…?

…Through continual product innovation and having deep domain expertise that would be hard to replicate or bring in-house.

This domain specialism and ongoing product innovation was a primary factor that attracted us to DriveWealth. Bob and the team are extremely experienced brokerage experts – they’ve lived and breathed the industry and know its complexities better than anyone. They’re also continually innovating and helping their clients offer new and exciting features to their end customers. Being on the front foot and driving forward new features and functionality means that DriveWealth remains a core vendor and strategic partner for its clients as they scale, not just a static piece of technology that can be replicated.

3. Owning and monetising the full stack

Building on the previous two points, the ability for infrastructure platforms to attract high-growth clients and remain a core vendor at scale, is also closely linked to their own cost base and revenue model.

For middleware-only providers, sat on top of others rather than owning the full wider stack, margins can come under threat. Clients may be willing to pay a slight premium for ease of integration and orchestration at first, but as discussed, at scale the ‘build-vs-buy’ calculation becomes very relevant and it’s easy to be squeezed.

Owning more of the stack means being able to control more of the cost base, have greater flexibility with pricing, and (depending on the market), monetise both ‘back-end’ and ‘front-end’ revenue. This is not always possible: in some geographies and segments, such as banking-as-a-service in the US for instance, the regulatory landscape makes it extremely difficult to be more than a middleware provider. But even in this example, many of the successful middleware platforms have a twin revenue model, charging both the sponsor banks and their ‘front-end’ clients.

So again, to bring it back to DriveWealth – we invested because they understand this. They monetise across the stack, they hold the complex regulatory licenses and they’re continually building depth and owning more of the value chain. DriveWealth is far from middleware; they’re building the end-to-end infrastructure for modern day brokerage.

We believe embedded finance infrastructure providers will be the backbone of the next wave of fintech innovation. But equally, we know that not all fintech infrastructure is created equally. We’re really pleased to be partnering with DriveWealth as they shape and power the future of embedded brokerage. There’s not a pick or a shovel in sight, but we do think they’re sprinkled in gold (puns = OK).

Click here to subscribe to our newsletter.