Our thesis and insights

Despite commitments to tougher new net zero targets at 2021’s COP26 conference, research shows that progress on broader sustainable development goals has actually reversed in the past two years1.

Venture capital can help advance the goals of Sustainable Finance (SuFi) in three ways:

1. By defining and applying ESG values and policies to complement and support how a fund operates and maintaining transparent accountability for the results.

2. By encouraging existing portfolio companies to consider and, crucially, measure the broader impact of their business and decisions.

3. By focusing on measurable Environmental, Social and Governance (ESG) outcomes and directing capital towards those initiatives most likely to deliver them. While the space is in its infancy, we are seeing untapped opportunities in specific areas where finance and technology can drive positive impact, mostly at the intersection between ESG and circular business models.

Here, we focus on what we are looking for in the context of our investment, but you can read more about our ESG approach at Mouro Capital.

The need for action is more urgent than ever before

ESG concepts that have permeated society in recent years have gathered urgency due to the deepening climate crisis and increasing social divides that emerged as a result of COVID19. Historic pressure for a more proactive corporate approach to ESG has now gone beyond informal shareholder demands and regulatory guidance to the heart of global markets and new, tougher regulation. This regulation itself may end up shaping the market faster than private enterprise alone. As VCs, we need to be able to anticipate change early and back the companies we believe are poised to take advantage.

The rise in shareholder and societal pressure and ESG investments has not translated into measurable positive outcomes.

• After decreasing in 2020 because of reductions in industrial activity and levels of commuting during the pandemic, carbon emissions are expected to rebound to pre-pandemic levels.

• As global populations have grown over the past decade, so too has both consumption of natural resources and the amount of e-waste generated and not recycled.

• Gender and ethnic disparity remains, with women and minority groups still underrepresented in government and corporate leadership positions globally.

A two-pronged approach

Asset managers, risk assessment teams, and credit agencies have the huge task of navigating evolving regulatory requirements for their portfolios, despite a lack of defined taxonomy and data often being self-reported. Even if there is friction between understanding and consensus in what are still the early days, the opportunities outweigh other considerations. Very few commentators are questioning the need for ESG standards, so it’s not a question of ‘if’ standards will be introduced, but rather one of ‘when’ and ‘how’. And technology is critical in addressing the gaps that exist in measuring and reporting ESG consistently.

Better information and more accurate data are key to building trust and combatting greenwashing, so that capital is allocated to companies that have a true (and provable) positive impact on the environment or society. Better data also helps to identify those areas where stakeholder activism could lead to significant shifts to more sustainable practices. Our appetite for investment here extends to companies that steer allocation of capital to environmental and sustainability initiatives such as ESG investment management products and impact reporting services, the promotion of green financing initiatives and carbon markets.

At the same time, we need to shift away from focusing just on ESG and consider SuFi as a broader category. It’s a step that requires us, not just to catch up on measuring impact today, but investing through the pipeline in the models that will help fundamentally change our relationship with these issues, and urgently adapt for the future.

While existing business models come under scrutiny, we also need to identify what new models will deliver the broader shift towards sustainability. The circular economy can be a big factor in reducing emissions as it moves us on from the ‘take, make and waste’ principles that have dominated the past two centuries, to focus on the notion of ‘reduce, reuse and recycle’.

Within the circular economy our appetite for investment is focused on business model innovations that have the potential to change how companies generate value by leveraging new ownership models and technology. Within this framework, the ability of a company to scale across multiple sectors or target a single vertical with a large addressable market is key.

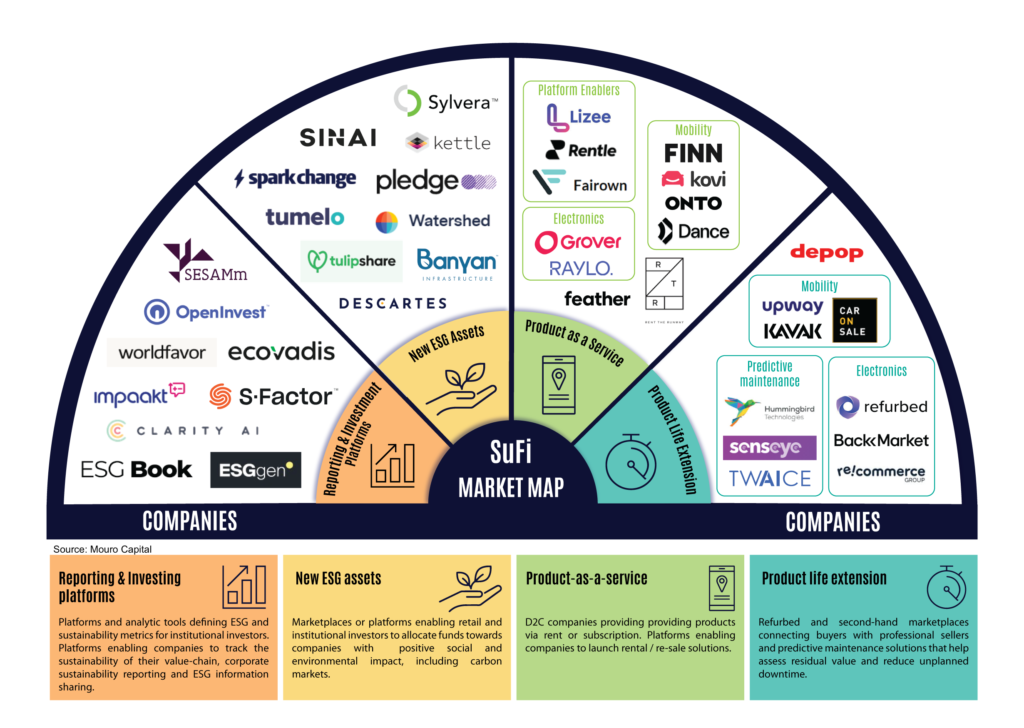

Figure 1 – Sustainable Finance Market Map

Opportunity 1: ESG platforms for reporting and investing

The absence of a clear and common definition of ESG measures or legal framework to govern them is one of the main challenges to success. Standardised policy making and regulatory initiatives ought to help define the issues and enable meaningful company comparisons in future.

Lack of framework and self-reporting today allows companies to hide or obfuscate their data to appear to suit their needs. And even for those who want to do the right thing, it can be cumbersome to have to collect different data for multiple requests coming from investors, procurement departments, regulators, and many others.

The ability to build trust with more accurate data and reporting will lead to improved capital allocation to companies having a positive ESG impact. We are particularly interested in platforms and analytic tools that offer to codify ESG and sustainability metrics and screen potential ESG investments on behalf of institutional investors. Also, those that enable companies to track sustainability in their supply chain, improve corporate sustainability reporting and share ESG information.

Several companies have developed solutions that aim to help investors and asset managers weigh up ESG metrics for public markets. In 2021, some leading financial institutions partnered with, or acquired, new ESG data providers that are using technology to assess ESG risk and standardise scores.

While public market data is becoming increasingly commoditised, the private and SMB spaces are significantly more complex, given resource constraints. New policies and regulatory forces are likely to increase reporting requirements and those companies able to standardise data requirements, incentivise collection and create network effects are the ones we see more likely to succeed.

Opportunity 2: New ESG Assets

S&P’s Global Ranking expects sustainable bond issuance (including green, social and sustainability linked bonds), to exceed $1.5 trillion in 2022, up by more than 50% on 2021 and from just $200 billion in 2018.

As both private and public sector players tackle their climate commitments, we expect further diversification and innovation in investment products. The sustainable finance market has continued to expand beyond green bonds with several new assets coming to the market, ranging from institutional and retail carbon instruments to sustainability investment platforms and marketplaces.

For example, SparkChange structures and issues green financial products in the form of carbon instruments, allowing investors to take direct exposure to EU’s physical carbon allowances market.

With increasing regulatory and societal pressures, we think that in the not-so-distant future, companies will have to report on key sustainability metrics and take active steps to reduce and offset their footprint. Because of this, we see opportunities in marketplaces or platforms enabling retail and institutional investors to allocate funds to companies with positive social and environmental impact.

When it comes to carbon, we believe that reducing is better than offsetting but high-quality offsets, like removals, are necessary to speed the path to net zero. Despite many companies starting to offer solutions, there are still obstacles to scale and remove significant amounts of carbon. Automated footprint measurement tools, verified carbon removal offsets and a targeted approach to heavy polluting sectors are critical differentiators.

Opportunity 3: Product-as-a-service

Product-as-a-service (PaaS) models are emerging across every industry from automotive, to IT hardware and industrial equipment. Just as with the ‘device-as-a-service’ industry, the compound annual growth rate is expected at 38% from 2021-25, reaching more than €476 billion globally. Companies with a PaaS business model sell the functionality of a product, rather than the product itself. Thus, property rights remain with the supplier and customers use the product through a lease, subscription and/or pay-for-use arrangement.

The model helps reduce environmental impact by sharing and extending the use of an item, and supports affordability by charging regular small amounts, rather than the full value at once. But this changing cashflow scenario introduces new challenges. In particular, the heightened potential for attracting credit-compromised customers to this type of contract financing calls for robust pre-contract assessment.

While the appeal for customers in this model is clear, the incentive for merchants is more opaque. Opportunities will emerge to generate extra revenue as new product categories become more mature and it becomes easier to assess residual value (for example, electric vehicles and their batteries) and through adjacent services, such as auto insurance and servicing (to continue the automotive theme).

We see opportunities emerging in these areas:

• Platform enablers that help companies launch rental and/or resale solutions, typically involving white label front end solutions, data platforms and logistic services.

• Companies providing B2C PaaS solutions, such as platforms to rent or offer products, like electronics, via subscription.

Opportunity 4: Product life extension

The challenge in shifting to PaaS models is that customers are required to take care of a product they don’t own. Their failure to do so erodes residual value and inhibits the creation of strong secondary markets. Increasingly, machine learning and IoT technologies are being applied to make more efficient use of a product and facilitate repairs before failure. Such predictive maintenance gives rise to data that is key to better estimating residual value and makes it easier to create secondary markets that price-in risk.

In turn, the proliferation of second-hand markets allows better understanding of objective residual value. When products have a positive residual value, they don’t have to be written off to zero in accounting terms, improving their economic appeal and ability to attract finance. Increasing the lifespan of a product is a core principle of the circular economy, and predictive maintenance and growing secondary markets facilitate life extension.

We see opportunities in:

• Refurbished and second-hand marketplaces connecting buyers with professional sellers to acquire certified and guaranteed assets at reduced prices.

• Predictive maintenance, such as cloud-based software solutions that help assess residual value and reduce unplanned downtime, thus making it easier to create secondary markets.

Where do we go from here?

The SuFi space is, of course, much broader and more complex than outlined here: (green) energy, commodities and sustainable housing are all areas we’re keen to explore further. But SuFi is ripe with opportunities for those who can smooth the transition to net zero. By tackling the issues from two directions – through new ESG platforms and assets that improve measurement, and by helping to grow the circular economy through PaaS and product life extension – businesses and individuals should start to see the positive impact of their actions.

We’re excited to hear from anyone working on solutions in these areas, to advance our own thinking and accelerate our path to sustainability.

Click here to subscribe to our newsletter.