Our thesis and insights

As with all things, to understand the future of insurance, it might first be useful to delve a little into its past.

For an industry that thrives on looking ahead to anticipate the unknown, insurance has been surprisingly slow to embrace technology innovations. This is due in no small part to the difficulties that new entrants face in trying to compete with their incumbent rivals, whose grip on the market is long in the making and deeply entrenched.

Most companies that might be considered insurtechs today, typically started life as managing general agents (MGAs), which earned commissions for winning customers and underwriting policies on behalf of a licensed insurer. Even now, the companies that attract most funding still operate in that traditional space, simply deploying new technology to pick up customers faster and cheaper.

As these companies start moving up the value chain to get more control over their product and risk allocation, they often need to obtain regulatory capital, which can be difficult for a startup to access with only limited proof points. Incumbents, on the other hand, benefit from years of claims history (i.e. data), have sizeable operational scale and also spend heavily on their brands and marketing. It’s given them a strong grip on the market, but it’s also driven up the cost of customer acquisition.

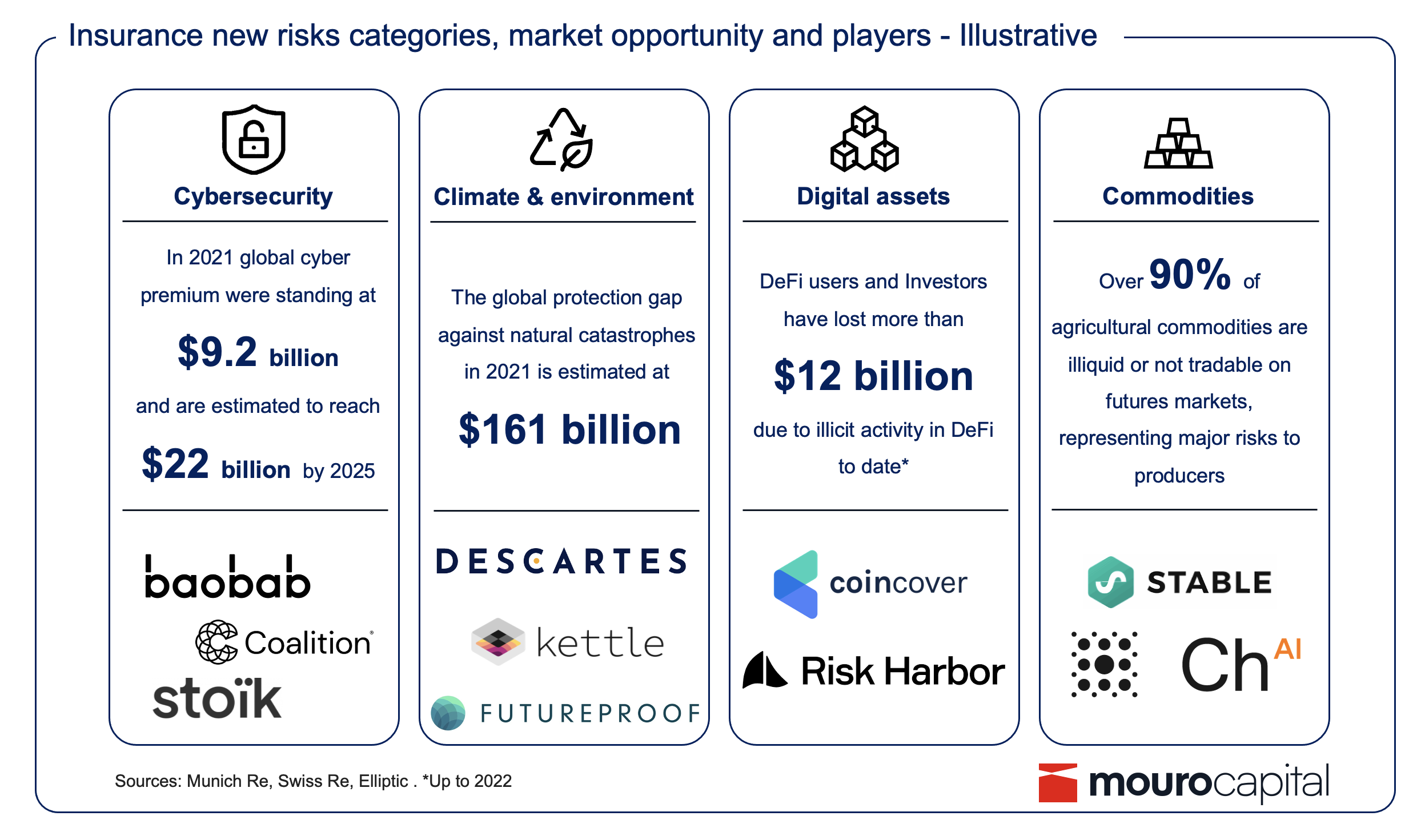

Now, as new categories of risk emerge, including climate and cyber insurance, weighted supply chain and commodity risks, incumbents have relatively few historical data sets to rely on, providing fresh opportunities for tech disrupters to enter the space and compete head on. New players, backed by technology, and drawing information from such sources as IoT devices and satellite can establish themselves as next-gen carriers or support their old-world counterparts in underwriting; helping to define the risk and, therefore, make it more insurable.

So, what are those risks?

Cyber. Unsurprisingly, shutdown of essential services and critical infrastructure is the main cyber-related risk, but identity theft, cyber extortion and proliferation of ransomware all pose concerns. In this space, Coalition is one of the most established players but new European players targeting SMEs such as Stoïk and Baobab are emerging quickly.

Climate and environment risks, including physical risks, made up of changes to the frequency and severity of natural catastrophes; also longer term trends, such as increase in average global temperatures and sea level. Transition risks arise from carrying out actions necessary to steer society towards carbon net-zero, including changes to government policy, business models and the adoption of new technologies. Finally, litigation risks increasingly result from the failure of various public and private entities to adequately address the climate crisis or disclose the true extent of climate risks. In this space, Descartes Underwriting has built a broker network for its parametric insurance business that protects corporate and government clients against natural catastrophes and weather. Focusing originally on wildfires in California, Kettle has expanded its reinsurance platform, leveraging billions of data points to help carriers better model their risk.

Digital assets offers risk solutions to companies operating in blockchain technology and crypto, for example, to protect custodians or a crypto wallet against the theft of tokens. This is a fast growing area, despite the lack of regulatory oversight and security standards for hot and cold storage. Coincover, which has developed a preventative technology protecting both businesses and retail investors and backed by an insurance policy, is probably the best example of its kind in this category.

Commodities insurance helps manage volatility-related risks. Stable, for instance, helps businesses manage commodity price risk by offering targeted, index-based price insurance policies, covering products that cannot be hedged on traditional commodity futures markets.

Of course, success or abject failure all hinges on whether or not these new categories of risk are actually insurable. The brief answer is ‘yes’, but the more sophisticated our understanding of each one, the more appealing it will be to reinsurance capital providers of all kinds, which will likely further boost insurability.

We are already seeing better use of data and technology but, unlike many other categories, past experience is not a reliable guide to future impact in this instance. Indeed, the absence of historical data, making it difficult to predict emerging risk, is exactly what opens the industry to tech disrupters and new entrant innovators. As already mentioned, smart solutions like using data from IoT devices and satellites, are helping to capture more granular data sets and run more accurate scenario forecasting to better price the risk.

Also, new product evolutions like parametric insurance which, rather than covering the magnitude of losses (as traditional models do), pays out when a predefined event, like flooding or a hurricane happens. With no on-the-ground loss adjustment required, this type of cover keeps relative costs low while still offering precise protection.

And with better distribution comes a kind of ever-increasing virtuous circle. As newly insured events proliferate, they spur further product enhancements and extended coverage, which means customer sophistication, data availability and intelligent learning should all increase, deepening our understanding of these new types of risk category and further enhancing their insurability… leading to further distribution, more product development and so on.

The challenges that remain

We have looked previously at some of the questions and unknowns at the intersection of risk and technology, including the requirement to create large enough revenue pools and reach scale in an asset- and regulation-light way. Now we probably need to add education to that list, as carriers introduce new customers to their product profile, or work with brokers to outline key risks and terms. Emerging risk — be it the effect of climate change on supply chains or the impact of cybercrime — are increasingly interdependent and call for a holistic approach, from identification to management. That said, there are still some category-specific challenges to focus on.

Newly emerging risk can be sudden and difficult to anticipate. Take cyber insurance for example: brokers and businesses need to resolve issues before attacks can happen, but carriers often rely entirely on a one-time security scan at the time of underwriting, which is frequently outsourced to third parties. More advanced players are mitigating their risk with active monitoring, including regular scans to detect vulnerable portfolio businesses and in-house security functions.

Continuing the cyber insurance example, ransomware poses a particular challenging because it enters something of a negative spiral. If a company is more likely or faster to pay out a ransom because their insurance covers them for such an event, attacks become more profitable and therefore increase, leading to more companies buying ransom insurance and so on.

But, as with most things, data – particularly limited and fluctuating data sets – remains the critical factor. Commercial insurance is the most challenging coverage to underwrite as insurers typically rely on loss runs, which can lead to underwriting blind spots for businesses that have no prior claims information, or new businesses that have not been around long enough to file a claim. And, whereas consumer P&C insurance is characterised by frequent small claims, commercial coverage features fewer but (often) larger and more complicated claims, such that one bad year has the power to wipe a company out.

With so much still to be seen — not just concerning new risks, but also their potential impact on economies and society as a whole — we can expect the face of insurance to change dramatically over the coming years. And, whatever the ultimate outcome, you can be sure the transformation itself will prove an eventful journey.

Click here to subscribe to our newsletter.