Our thesis and insights

What needs to happen for insurance to take off in emerging markets?

January 11th - 2023

Getting sick or injured is more than simply a nuisance for millions of individuals throughout the world. When a family’s primary provider is sick or unable to work in nations without universal healthcare, the entire family may fall into poverty. Something similar happens if one’s business is robbed, machinery becomes unusable, or a major incident occurs in any industrial or services companies which may be the basis of a family or community’s livelihood. Unfortunately, those who are most susceptible to suffer in these circumstances are frequently those who are least likely to have access to insurance or inexpensive healthcare. But while insurance can shield millions of people from economic shocks, the penetration of insurance in developing countries is significantly lower than in advanced economies.

Insurance coverage in emerging markets is low

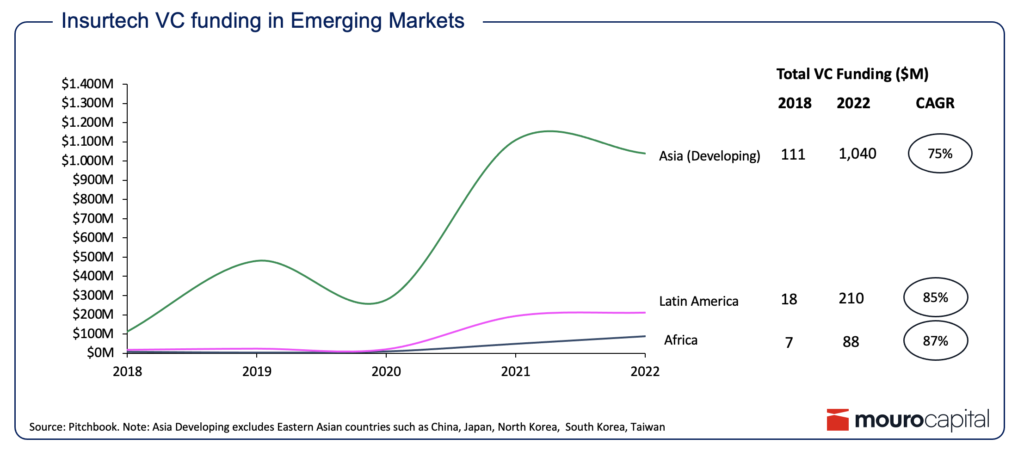

While in mature markets, people tend to start with auto, renters, and property insurance, and corporates are shifting to new risks, the entry point in emerging markets is likely to be health or life insurance, especially for lower-income individuals. Over the past few years, inflows of VC funding to the emerging markets of Latin America, Africa and Asia have grown exponentially from ~$136m, representing 3.5% of global Insurtech funding in 2018 to over $1.3billion contributing 19.8% of global Insurtech funding in 2022 (Figure 1 – Insurtech VC funding in Emerging Markets).

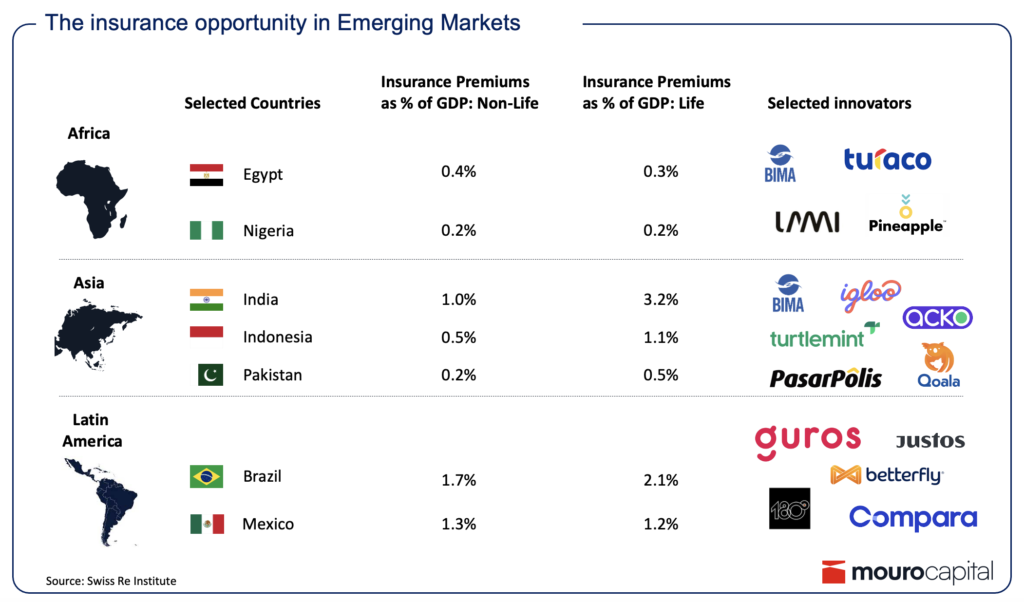

However, challenges from both the demand and supply-side continue to limit insurance uptake. From the demand side, with low disposable income and money increasingly tight, most people decide not to pay annual premiums to protect their life, health and other assets (Figure 2 – The insurance opportunity in Emerging Markets). And the informal nature of many emerging economies poses its own challenges for insurers. Take car insurance, for instance, where it’s not unusual for repairs to be done outside of the manufacturer’s branded network, often with generic or refurbished replacement parts. The same with mobile phones and the prevalence of second-hand handsets.

From the supply-side, there is a double-edged sword of product complexity in an environment of relatively low financial sophistication. From a product perspective, in addition to opaque cost structures and complex language, problems of manual processing which lead to high turnaround time in issuing policies, a lack of standard product features, a shortfall in assistance for filing claims, and lack of transparency around costs are still affecting several providers.

In most emerging markets, the share of disposable income that insurers might expect to pick up is still lean which, combined with the high cost of traditional distribution channels, like agents, often makes the business case difficult to justify or reduces propensity to invest. Bancassurance distribution is typically not effective, given the markets’ low banking penetration.

Finally, lower ‘legal security’ attributed to underlying assets such as home ownership, can render insurance claims hard to execute or opaque.

This presents an opportunity

The emergence of some encouraging macro trends suggests that there is clearly opportunity for growth in these markets. Digital adoption — internet penetration, smartphone penetration, payments wallets and online shopping – has increased significantly over the past ten years with a growing incidence of tech savvy emerging consumers going straight to mobile first.

With continued growth of disposable income, households in emerging markets might be expected to diversify their consumption and buy more financial and insurance products in response to the change in lifestyle. In India, for example, growing financial literacy, urbanisation and the advancing education system are all prompting a ground swell in risk awareness and, with it, the need for protection products. And India is not alone. The middle class in most emerging markets is growing fast, leading to a boost in disposable household income which, given a less well-developed social security infrastructure, leaves a larger protection gap that insurers can fill.

So, what needs to happen?

As with everything, it starts with good design – simple, tailored products aimed at a well-segmented consumer population and standardised to breed familiarity and, therefore, take up. Since 2010, Bima has provided life and health insurance policies through a mobile first platform targeting underserved and low-income families, in most cases accessing insurance services for the first time. After the start of the pandemic, Bima accelerated its deployment of telemedicine services. In the context of low trust and first-time buyers of insurance, adding a human touch to a digital solution is important. For example, in Indonesia, PasarPolis, has onboarded 60,000 mitras (small, family run businesses) who can facilitate customer education and insurance product purchase on its digital platform.

An additional success factor is digital distribution. Since consumers in emerging markets rely less on traditional distribution networks, the growth of insurance there will be tied to the capability to find new ways to connect with customers digitally. Comparison sites, already the mainstay of more mature markets, bring price transparency and product standardisation, and while it is difficult for new players to differentiate or innovate, they can enhance the sale process for simple products. Guros in Mexico and, Compara in Chile developed marketplaces offering consumers tools to compare and purchase a car and travel insurance as well as other financial products such as consumer loans and credit cards.

Distribution advantages can also be found through the right partnerships. Partnership with super apps and mobile money providers, in addition to closing the protection gap and solving some of the supply and demand issues mentioned earlier can bring additional benefits. Mobile money has simplified premium collection for insurance providers, enabled more tailored product offerings through the use of big-data as well as making claim pay-outs faster and seamless for customers. And for partnerships with super apps, look again at PasarPolis, which distributes embedded insurance products through partnerships with Go Jek or with e-commerce players such as Bukalapak or Shopee, which offer point-of-sale insurance.

The B2B2C embedded model is also picking up quickly in developed and emerging markets alike. Take Kenya’s Turaco, where distribution innovation plays a key role in helping their partners bundle insurance with their core products or services through API integration. In Brazil, 180 Seguros has a similar B2B2C model where it helps its partners provide insurance products across home, health, and property & casualty. Among these is the country’s first home insurance that has a points-based assistance program, and the region’s first insurance with intermittent coverage for vehicle belongings.

We believe that regulation is the final piece of the puzzle, not only for stronger consumer protection and better customer services but also to continue the shift towards digital transformation. Following the success of its recent open banking initiatives, Brazil is launching an open insurance initiative which will allow customers to share product data between different insurance companies, and insurers to use customer information to offer more personalised products and services.

The combination of factors such as increased digital penetration, and new digital distribution models, is increasing access to insurance for those who may need it most. Among other things, regulation can bring confidence in these services which strengthens the case for individuals and businesses to adopt as markets develop.

Click here to subscribe to our newsletter.