Our thesis and insights

Alternative strategies for institutional investors

May 18th - 2022

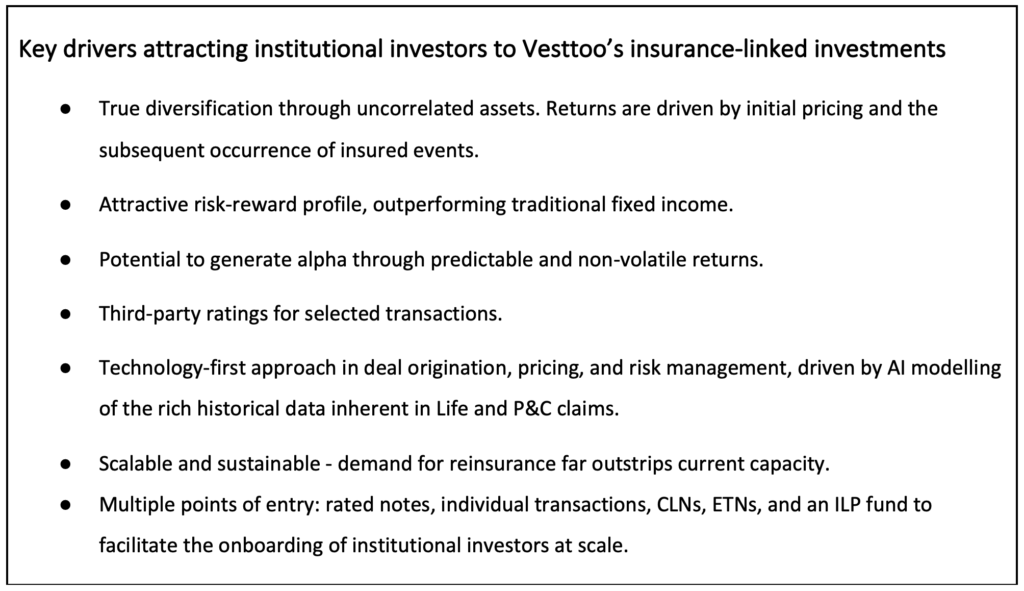

Insurers and reinsurers have long struggled with risk exposure, capital requirements and limited reinsurance capacity in a highly centralised market. Portfolio partner, Vesttoo helps iron out these issues by bridging the gap between insurance and capital markets with an innovative tech-enabled marketplace, which makes it easy for capital markets investors to enter the insurance ecosystem.

While traditional insurance-linked securities tend to focus on the more volatile areas of catastrophe and climate risk, Vesttoo securitises Life Insurance and Property & Casualty (P&C) liabilities. Vesttoo’s data-driven technologies translate liabilities into standardized investment products that capital markets can understand, backed by proprietary AI that models the large amounts of data typically associated with insurance calculations. As a result, insurance companies that want to free capital from their books via reinsurance can access increased capital directly from outside the market, helping to close the ever-widening protection gap in the insurance industry.

With several points of entry, including their flagship Insurance Linked Program, bespoke transactions, third party rated structured notes and credit linked notes, Vesttoo plans to further open up to retail investors via exchange traded notes, all accessible through their AI powered digital marketplace. Investor counterparties – anyone from large asset managers to family offices – can enjoy easy access to portfolio-diversifying Life and P&C linked products, offering better predictability and projected ROI for 5 years of 5.28% 1 with a Sharpe ratio of 2.04 2.

Vesttoo’s focus on P&C and Life means that they can access significant volumes of historical data to train the AI and generate data-driven risk and expected loss projections. This allows efficient structuring of insurance-linked assets that have attractive yields for investors while maintaining competitive pricing for insurers with a faster time to market. The technologies used provide the data and transparency needed for third-party agencies to rate the linked notes, a first in the industry for these types of transactions.

Since the company began to transact at the end of 2020, Vesttoo has placed over $2.5 billion in capacity. We are excited by the significant potential for growth in this market and other areas that can be served by Vesttoo’s scalable platform, including expanding activities in areas such as life & health and unfunded pension liabilities.

We’re thrilled to partner with Vesttoo, leading their Series B funding last November, and the team behind its success. And, with a platform built for rapid scaling, we look forward to what future performance they might deliver.

[1] Projected return on average collateral

[2] Calculated using projected average return on collateral, standard deviation of industry-wide underwriting margin (taken from NAIC data across relevant LOBs) and a risk-free rate of 1.85%

Click here to subscribe to our newsletter.