Our thesis and insights

With interest rates at a 15-year high and a mountain of consumers shopping around for the best place to move their money, there is a lot of additional revenue to be made in banking right now. Look also at Revolut, which has been the subject of widespread speculation surrounding its application for a UK banking licence. But, tempting as the rewards may be, a great deal hinges on making the right decision as to what level of licensing – and therefore regulation – financial institutions apply for. Making the wrong choice can be a costly and time-consuming error.

Whatever the activity, finance is a regulated industry, so complex approvals and oversight come with the territory, but a banking licence is by no means the only option out there. Electronic Money Institutions (EMI) and Credit Institutions also occupy the space on the fringes of banking and are often preferred by fintechs, especially at early stage, for giving the extra flexibility to manoeuvre and preserve their much-valued agility. The decision as to where to sit on the licensing spectrum is far from arbitrary – it establishes the scope of operations and shape of the regulatory journey for many years to come.

The definition of banking is ‘the regulated activity of accepting deposits. This definition stipulates that, a) money received by way of deposit is lent to others or, b) deposits are used to materially fund a business line. So, the establishing question for a firm contemplating a banking licence is whether or not their business plans fall in line with that definition.

Banks are among the only industry category that can generate revenues from both sides of the balance sheet. A bank asset are its loans, its liabilities, that customer deposits earn interest from. The main benefit of becoming a bank is in owning your own balance sheet and, particularly in the present climate, this can equate to significant revenues. Fintechs like Monzo and Starling, that have made the transition have benefited. For the year ending in February 2023, Monzo’s Net Interest Income grew 382% to £164.2 million. Starling also experienced a strong uplift in Net Interest Income from £121m to £348m.

On the other hand, an Electronic Money Institution licence authorises the holder to issue electronic money and enable electronic payment transactions without engaging in the full range of banking activities. As a result, it comes with a slimmed-down set of regulatory obligations.

Leveraging banking-as-a-service providers can also allow operators to earn interest on deposits but, typically, within a revenue sharing structure. Look at Wise, which operates with a payment license and has seen its interest income rise from £4m to £140m over the last year on deposits of about £10bn.

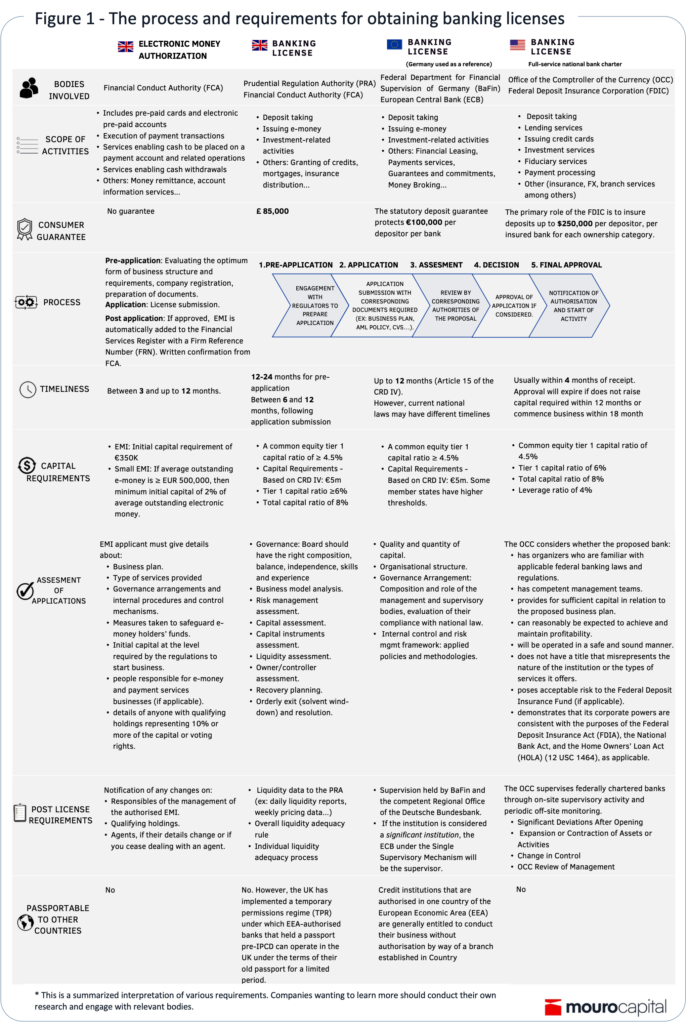

Successfully obtaining a banking license is not something one can bet on, there are defined rules and procedures to follow in the process and some precise implications following the receipt of one. We’ve tried to demystify the process in figure 1, and show some of the steps, requirements and implications in different developed market jurisdictions; also some of the nuances and differences between markets. At Mouro Capital, we are fintech specialists and have helped many of our companies navigate regulatory licensing, whether for company build up or international expansion. In another article, we will look at emerging markets and the specific paths that two of our portfolio companies, Creditas and Klar, took to obtain banking licenses in Brazil and Mexico.

So, what are the key things to consider?

Process and timelines

In the UK, firms typically spend 12-24 months before even submitting an application, following which regulators take another six months to reach their determination. The process is similar in Europe, with a pre-application stage during which supervisors engage with the applicant prior to formally submitting for a licence. In the Euro area, the entry point for all applications is via the national supervisor of the country where the bank will be located. They and the European Central Bank (ECB) are then involved at different stages in the process, coordinating closely before the latter makes a decision to grant or not. Depending on the relevant national regime, requests for further information can often delay timelines significantly.

At the end of the process in the UK, the regulator will either grant a license or, in the case of firms that haven’t yet fully developed their operational capabilities, go to a mobilisation stage. This allows the new bank up to 12 months to complete the remaining build-up. For example, in the area of governance, a fully-fledged banking licence recipient will have all key senior management roles in place and independent non-executive directors; an entity going down the mobilisation route will have a minimum of Board Chair, CEO and one other Executive, with other roles identified and ready to recruit. Regardless, all new and mobilising banks must meet threshold conditions and capital and liquidity requirements at all times.

In the US, the dual banking system means the regulatory landscape is fragmented. Banking licenses are issued at both the federal and state levels, with distinct requirements for each. Banks can choose to operate under federal charters (issued by the Office of the Comptroller of the Currency – OCC) or state charters (issued by state banking authorities). Different standards apply to community banks, which typically enjoy more flexible regulations, and national banks that are subject to stricter federal oversight.

Requirements

All application assessments follow a similar path, with regulators wanting to ensure how the business will be profitable, what risks their activities pose and how they are mitigated, key governance and organisational structures and risk management frameworks among other key points.

• Governance: Regulators typically assess whether a board has the appropriate composition, balance, independence, skills and experience necessary for its new banking role, also whether conflict of interest, management procedures and succession plans are in place.

• Owner and controller: A regulator will review the firm’s controlling parties and ultimate owners, as well as their sources of funds, to assure they are fit and proper. In Europe, if the shareholders of the applicant entity hold more than 10% of capital or voting rights, or exercise a significant influence over the management of the entity, qualifying holding criteria will be applied. If there are multiple smaller shareholders, without qualifying holdings, the 20 largest shareholders will be assessed. As you might imagine, this is not without its complications: when looking at VC backed companies, for example, different classes of shares may have to be harmonised into some kind of common form, which late investors can perceive as giving up control or protection rights.

• Interpretative- vs. rules-based regimes: The degree of flexibility between adhering closely to a set of rules or interpreting broad principles, varies in Europe from market to market. As part of a compliance assessment, however, firms need to be able to show that they have done things in a certain way and that the internal culture is focused on customer outcomes.

Post license requirements and ongoing monitoring

Banks undergo regular stress tests, assessments and audits, ensuring financial stability and consumer protection.

• Cost of credit loss expenses allocation: Monzo said it had tripled its lending book, which, combined with higher interest rates on deposits, saw revenues more than double to £355m from the previous year. Yet Monzo’s overall results were diluted by putting aside cash reserves of £101.2m to protect it from the increased risk of potential defaults on these loans. These reserves, known as credit loss expenses, were up from £14m a year earlier.

So, if to bank or not to bank is the question, these are the salient issues as we see them, but they’re by no means exhaustive. The key to take away from this is that the decision is a defining moment for any operation.

Click here to subscribe to our newsletter.