Our thesis and insights

As a spike in bad loans looms, are debt collection technologies stuck in the past?

June 16th - 2022

At the beginning of the pandemic, lenders braced themselves and allocated record sums to loan-loss reserves. Unprecedented government intervention took the pressure off borrowers. But temporary aid measures are coming to an end, as are the years of low rates that compounded the growth of debt. We are expecting to see pressure on both personal borrowers and small- and medium-sized enterprises (SMEs).

This will shine an unfavorable light on some underinvested areas of the industry. While banks and traditional lenders have digitised most front-end activities, this hasn’t been the case for debt collections and arguably for certain parts of underwriting, both of which typically sit on core banking platforms that are 30 years old or more. Digitising can help such lenders improve their understanding of their customer base, reduce costs and, ultimately, supplement their capital resources through a greater recovery rate and better-calibrated loss provisions.

Lenders need better end-to-end infrastructure for credit processes over the life cycle of a loan.

Revisiting the regulatory treatment for bad loans and their consequences: why lenders should take action

Solutions for past-due loans range from on-balance-sheet measures, such as the establishment of internal workout units, to off balance sheet measures such as the disposal of assets to outsourced agencies. The former scenario potentially confers a greater financial benefit but ties up money and management time. The latter scenario represents a more rapid solution, but such disposals may not be viable for smaller or undercapitalised lenders that can’t handle high transaction and one-off impairment costs. This may also hurt lender-client relationships as debt collection agencies typically try to solve the problem from a lender’s perspective, often leading borrowers to enter bad-debt spirals.

When a lender is not under severe stress and access to recapitalisation is not at risk, lenders typically follow their traditional procedures. They can also shrink the relative impact of non-performing loans (NPLs) by growing the balance sheet.

In a more stressed scenario, higher-than-normal NPLs can wipe out profits and dividends for years. That can also mean higher capital requirements to absorb potential losses, an ensuing rise in funding costs, and a constrained ability to lend. A lender under this kind of stress is less helped by the standard playbook and would benefit from innovation.

How does credit management work today, from a lender’s perspective?

1. Usually, debt collection has been viewed as a people-based business.

The goal in collections was to get a customer on the phone to redress the situation or come to an alternative agreement. Employing agents skilled at persuading customers to agree to solutions does not come cheaply and passing on the debt to collection agencies may hurt lender-client relationships as typically, agencies are incentivised to solve the problem from a lender’s perspective, often leading borrowers to enter bad-debt spirals.

2. Old technology means missed opportunities to engage with customers.

For most traditional lenders, unsecured lending products still sit on core banking platforms that were built in the 1990s. They make it difficult to reach the customer in a personalised way through channels like smartphones that track interactions, and generally are not adapted to the multichannel strategies banks have carried out since the 2010s. Furthermore, unmodernised IT cannot handle steps that would help very early in an arrears journey, such as reducing the interest rate, extending loan terms and re-defining loan parameters after they become past due. We estimate that in Europe, about 75% of customers in arrears use online or app-based banking, which seems like a natural medium to redress the relationship.

3. Behavioural segmentation has barely begun.

There is a difference between borrowers who are unwilling to pay and those who are genuinely unable to pay. With lenders operating on a sort of auto-pilot, these categories are not being properly identified and both types of clients are bundled into a single relationship model that is likely to be inadequate for either one.

Most lenders still use contact strategies based on customer balance, risk profile and days delinquent. Collections are typically organised sequentially: sub-1 day, sub-5 day, sub-30 day and 90-day-plus thresholds trigger various actions that don’t “talk” to each other.

Some lenders are using emails and texts in early delinquency, but then abandon digital channels after 30 days, switching back to phone calls and letters.

What can innovation look like?

1. New models: AI-driven segmentation and contact strategy

Artificial intelligence (AI) and data analytics are key to enable customer segmentation and support the development of digital channels and self-service functionalities. Increased context on a borrower could trigger processes that differentiate between unwillingness and inability to pay which can improve both the lender’s risk management and the user experience (UX). For example, AI models can help understand the propensity of a borrower to pay at different moments in time through the lifecycle of the loan or a broader relationship.

As described by McKinsey, the objective is to deliver tailored messages, through the right channels, in the right sequence, to the right customers.

2. Ongoing credit scoring monitoring for dynamic servicing

Beyond simple metrics like a FICO score and income typically used to underwrite, lenders should continue monitoring customers and can apply data points from a borrower’s outside environment: GDP, demographic change, changes in interest rates. When combined with information about borrower behaviour, lenders can dynamically adapt affordability assessments and predict delinquencies, creating proactive outreach strategies for higher-risk customers as new variables come into play. Identifying trouble ahead, lenders can give customers support – helping them understand how positive and more problematic repayment behaviour will affect them.

3. New contact metrics

Common collections metrics and key performance indicators (KPIs), such as Right Party Contacts (RPC), and Profit Per Account (PPA), are still useful. These metrics respectively measure calls to correct individuals from whom collection is sought and the return generated for each account in collection (which impacts the bottom line) but they don’t give lenders a better understanding of customer behaviour.

On the digital marketing side, total email delivery rates, email bounce rates, email open rates, click-through rates, traffic by source or channel, landing-page views and reaction times are just a few of the KPIs that will help.

4. Being mindful of regulation

From a regulatory perspective, banks are often treated differently than digital lenders, impacting refinancing rates and terms that can be offered to customers. Open banking rules are also helping lenders consolidate their overview of a borrower’s financial situation, leveraging data from multiple institutions, as well as enhance fraud detection and improve credit-risk evaluation.

Regulators are also levelling the playing field and driving more effective customer engagement by placing limits on the scope and intensity of how collection can be pursued and ultimately help customers find mutually agreeable payment solutions and debt avoidance.

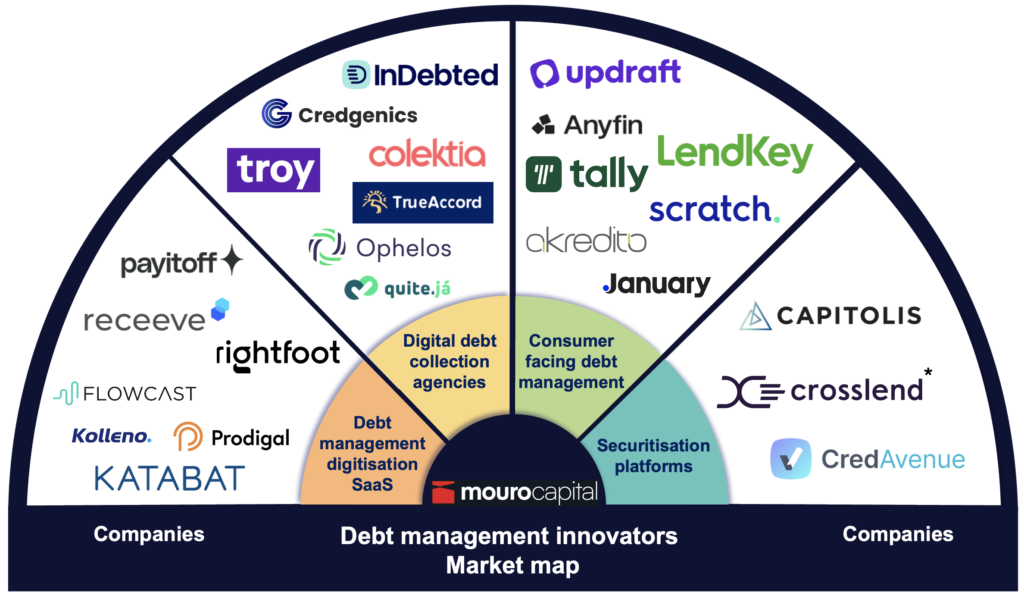

What are some of the business models in this space?

1. Debt management digitisation under the software as a service (SaaS) model: higher recovery rates, much lower costs

A data, analytics and application layer, powered by machine learning (ML), can be overlaid on a lender’s existing in-house collections, customer relations and communications systems. The more upstream such data layer sits, the more impact it can have.

Leading players in the space are defined by their ability to seamlessly integrate with lenders’ systems and provide a full view of every stage of debt management. From a commercial perspective, increased recovery rates and decreased collections costs on a per-loan basis are key. (Such platforms could scale across sectors other than banking: utilities and telcos come to mind.) As an example, Receeve, is a solution which can plug-in existing infrastructure and supports the end-to-end debt management journey from customer segmentation and building communication strategy tools to self-service payment tools, and debt-sale tools providing data for third-parties.

2. Digital debt collection agencies

A lender could outsource most of its debt servicing and related collections to a third party. Again, such an agency would improve on existing practice through better customer segmentation and innovative digital communications. Alternatively, a company would buy loans a discount and use the techniques just described to act on them.

While the existing market for debt collection agencies is relatively large (about $19 billion in the US), recovery rates are historically low. Despite efforts, around 30% of customers going into arrears don’t speak or repay resulting in lenders recovering around 10% of outstanding debt over a two year period.

In our view, the capital needed to purchase debt and the low recovery rates result in a balance sheet-heavy, risky business model. However, servicing can be better than buying and players in the space can be successful if they are able to improve recovery rates. As an example, a number of companies are trying to overcome these challenges by assessing a whole debt-portfolio and selectively buying customers once these have agreed refinancing terms.

3. Consumer facing debt management and consolidation platforms

It’s not just lenders: customers want to be able to restructure their debt burden, too. According to the Brookings Institution, 40 percent of U.S. student loan borrowers are expected to fall behind on repayments after the end of a COVID-19 moratorium. The recent rising rates and higher cost of living is also putting pressure on emerging sectors such as buy now, pay later, which experienced exponential growth in the past three years.

Innovators in this space make it easier for borrowers to refinance or consolidate loans and credit cards and avoid being punished by high, compounding rates of interest. One example is a refinancing startup called Anyfin. The user uploads a loan statement, is presented with repayment options, and then Anyfin settles existing loans. The company combines AI and publicly available data for its advanced credit assessment.

The combination of interest rate hikes, inflation and skyrocketing energy costs are likely to drive financial vulnerability and generate attention to this space. From a business model perspective, while the concept is simple, the downside is that it’s typical capital-heavy for a debt-resolution platform to buy debt.

4. Enhancing securitisation proactively

Securitisations are one of the most effective tools for lenders to deleverage. Swapping NPLs for securitised notes can be used as a balance-sheet management tool. When those notes are sold to the wide pool of third-party investors, underlying credit risk can be dispersed.

Platforms that can help securitisation already exist, such as Crosslend, a Mouro Capital investment. They integrate in the lifecycle of the loan straight into lenders’ books and blur the boundaries between internal credit books and an external(ised) securitisation platform.

There are also areas where lenders can benefit from improving their own technology. Better insights into a portfolio could result in early detection of degrading assets when they are still performing — meaning such credits can be prioritised for securitisation. Better homogenisation of key data — payment terms such as the amortisation profile and currency — helps make securitisation possible. Better IT also presents the prospect of more finely calibrated provisions, should regulators allow them, due to more granular insight into asset quality.

Click here to subscribe to our newsletter.