Our thesis and insights

Geographical fallacies – or why we are not *yet* European investors

May 13th - 2021

Often, we investors make what I call a geographical fallacy: we say that we invest in a region, when, in reality, we mainly invest in just one or two countries in that region.

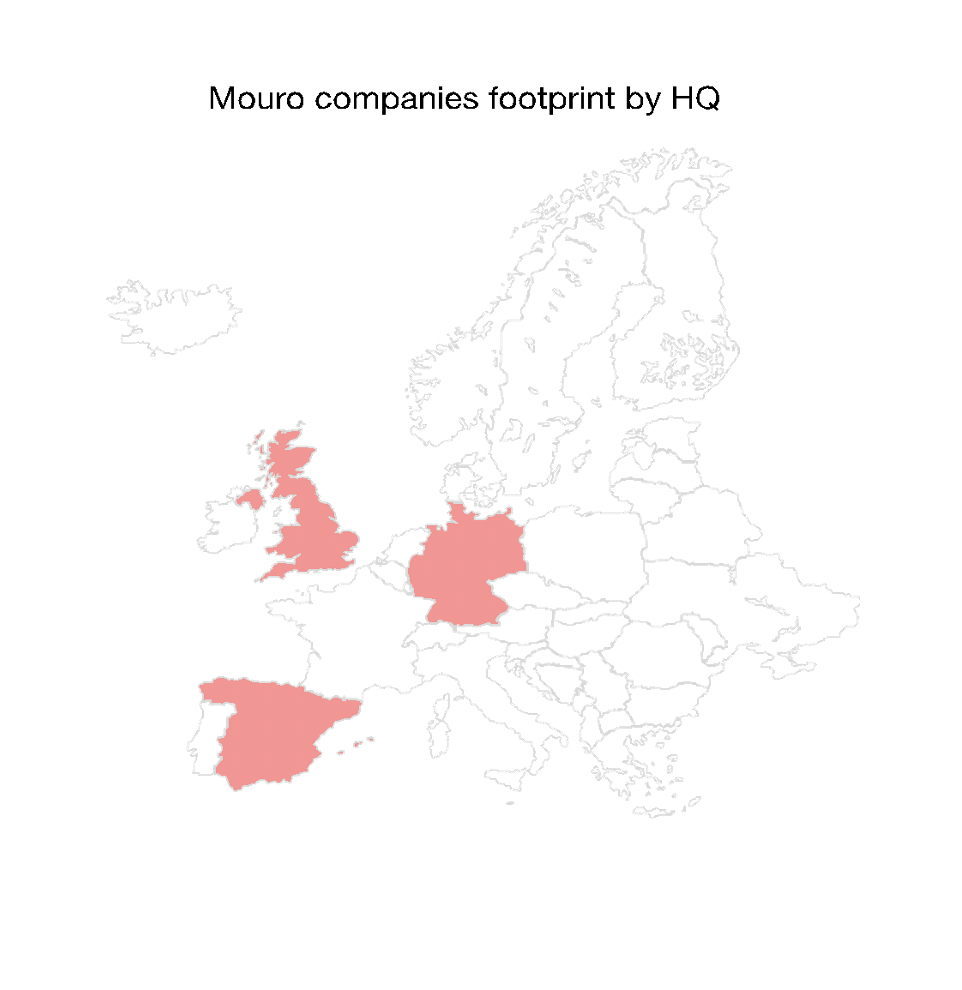

In my case, every time I explain who Mouro Capital is and what we do, I say “We invest in Europe, North America and Latin America”, when in reality, in Europe we have only invested (so far) in the United Kingdom, Germany and, most recently, Spain. The same goes for Latin America, where we have only invested in Mexico and Brazil – again, so far – but that’s for another post.

If we look at Mouro’s geographical footprint based on where our companies are headquartered, we see the following:

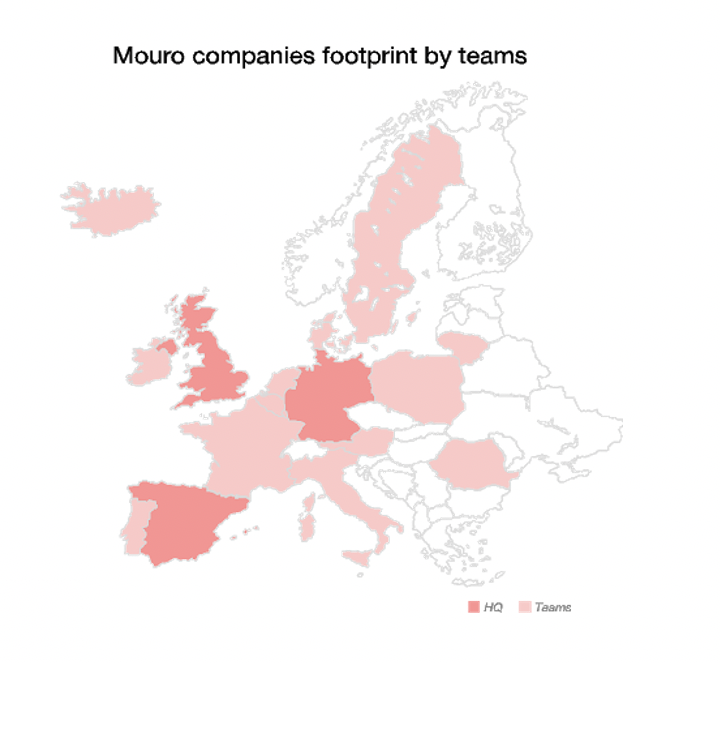

However, is investing in a company like Crosslend, headquartered in Germany but that also has teams in the UK, Luxembourg, and Austria, really only investing in Germany? Or are we also investing in the UK, Luxembourg, and Austria? Aren’t Crosslend teams in those four countries part of the same company, and as such, won’t they benefit from the investment?

There are, of course, arguments against this perspective, but they tend to focus on the realms of taxation and labour complexities. To my mind, this misses the point. The majority of the companies in which we invest are now, more than ever, multi-country. That is something we should recognize and be proud of. So, with this in mind, let’s look at our footprint based on where the teams we have invested in are located:

That more accurately reflects our European portfolio. That said, my intention today is not to launch a complacent pat-on-the-back argument that we have invested in more countries than it looks. It’s the opposite. I recognise that we can do better. Yes, technically, we have invested in Europe. Yes, if look at where our teams are, the picture improves. But in both cases, the geographical fallacy remains.

To me, investing in Europe is much more than investing directly in the UK, Germany and Spain, and therefore indirectly in other countries that those portfolio companies operate in.

To me, investing in Europe is investing in companies headquartered in Southern Europe, with Italy being named the country with the most entries in the for the first time.

To me, investing in Europe is investing in companies headquartered in Eastern Europe, with Estonia being one of the most advanced digital societies in the world and Lithuania becoming the EU’s fastest-growing fintech hub.

To me, investing in Europe is investing in companies headquartered in Ireland, with Dublin attracting global tech giants for quite some time now.

To me, investing in Europe is investing in companies headquartered in Benelux, where start-ups have seen increased attention from VCs in recent years. According to European Startups data, 2020 was a record year for VC investment into Benelux startups — at a whopping €2.7bn, up from €1.9bn in 2019.

To me, investing in Europe is investing in companies headquartered in the Nordics, which is already a consolidated tech ecosystem.

To me, investing in Europe is investing in companies headquartered in France, which is another consolidated tech ecosystem and the third most active VC market in Europe.

At Mouro, we are a diverse, multi-cultural, multi-national team; and we want our portfolio to reflect our essence and aspirations. In this effort, we want to take affirmative action and look for companies headquartered across Europe.

So here is my ask: if you are a company in one of these regions, and think there would be value in us connecting, please reach out!

A version of this piece was originally published on Financial IT. Click here to access.

Click here to subscribe to our newsletter.